As a small business owner, you wear many hats – developing the product, handling distribution, doing sales and chasing customers for payments, closing fund raising with investors and on top of all these managing your finances and keeping your books. This can be very overwhelming and you may need to outsource certain functions to in-house staff or independent contractors out there.

When it comes to your finances and managing your books, a great accountant is the difference between understanding the numbers that drive your businesses, taking data driven decisions and having a hard time figuring how your business unit economics are looking like, getting worries from the tax offices and difficulty tracking customer payments.

Whether you have worked with an accountant for years or it’s your first meeting, make sure you get the answers to these questions.

- What kinds of records should I keep?

You need to keep track of business records to; compute profitability, secure external funding and file taxes. An accountant can show you which records your business needs. Some records might include:

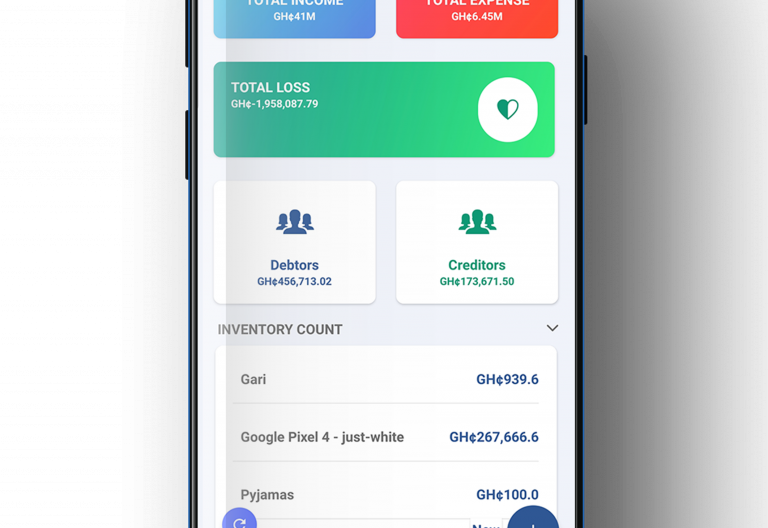

- Cashbook

- Payroll

- Invoice & Sales receipts

- Accounts Receivables (Debtors) & Accounts Payable (Creditors)

- Asset register

- Inventory records

This also includes getting to know what accounting system setup, tracking system and payment systems you need.

- How should I manage inventory?

If you sell products, an accountant can help you make decisions about your inventory (stock). How you manage stock can affect the taxes you pay, upwards or downwards. For example, the way you value stock affects your after-tax earnings and losses. An accountant can advise and help you with valuing your inventory, in the best interest of your business.

Also, an accountant can help you figure out the best time to buy more inventory and replenish your stock. Using cash flow projections, an accountant can determine when ordering new inventory will best impact cash flow.

- What is my break-even point?

The break-even point occurs when your total income equals your total expenses. It is the point of recovering costs. Your accountant can use different approaches to compute your business’s break-even point. By knowing this figure, you can see if your business is profitable or it is losing money.

The break-even point is very important for pricing your products and services. With that information handy, you can decide how many items you need to sell to cover your costs. An accountant can show you your break-even point after reviewing your financial records.

- What are my financing options?

You may need additional money to expand your business location or take on a larger project. An accountant can help you sort out the best financing option for your small business.

An accountant can help you choose between seeking funds from an investor or a bank. For example, you may need a business plan, or financial projections to apply for a loan, which an accountant can help you write. Your accountant can also compile financial statements for you such as balance sheets and profit and loss statements. Also, an accountant can advise you about what to look for in a loan.

- How can the accountant help me grow my business?

An accountant can help you pinpoint which opportunities best promote growth and can track your progress and see where spending brings your business down.

Also, an accountant can help you project cash flow. Understanding your cash flow makes planning for future expenses much easier and safer for your business’s finances.

This list of questions to ask your accountant may only be a starting point, as your accounting needs will vary depending on your size, industry, and location.

https://www.freepik.com/free-photo/woman-smiles-with-question-mark_961552.htm

Leave a Reply