As a firm, it is vital to know that implementing your chosen strategies means that you would carry on business. In doing so, you will experience money and other financial resources “coming in” and “going out”. These are generally what are termed revenues and expenses.

In this article, I share with you more about revenue and expenses. I start by considering what they mean and how different they are from gains and losses. Further, the line between incomes and revenues is drawn. Next, I talk about the types of expenses. I then end it all by explaining their implications for business with some crucial points to note.

What are revenues and expenses?

They are terms that business owners will often or daily have to deal with. There are generally two main activities of every business: those for which a business was set up and those that come along as business goes on. For example, a pharmaceutical firm is setup to deal in the sale of drugs. Selling drugs is therefore its ordinary activity but if this firm invests, investing becomes a secondary activity.

It is on this premise that we define revenues and expenses. Revenues are the increases in financial resources of a firm that results from its ordinary activities (activities for which it was established). The following therefore are revenues for the under listed firms:

- Money from sale of food by a restaurant

- Money from tuition by an educational institution

In the same vein, decreases in financial resources arising from a firm’s ordinary activities constitute expenses. In relation to the examples above, the following will be expenses:

- Money spent in food preparation by a restaurant

- Money incurred in providing tuition by an educational institution

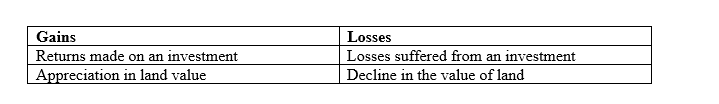

Gains and losses: How does revenue and expenses differ from these?

Sometimes, a firm may experience increases or a decreases in its financial resources but through activities that are not ordinary considering its nature of business. Such increases are called gains whereas losses are the decreases. Examples are seen below:

The difference between revenue and incomes

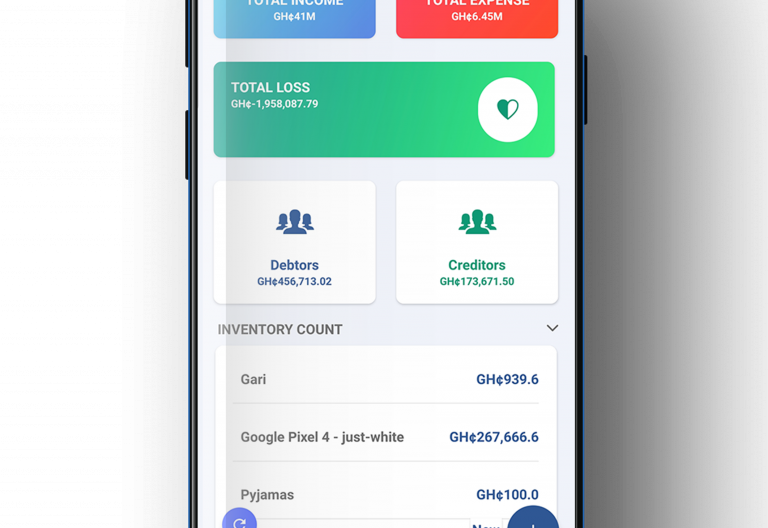

The incomes of a business are the sum of all revenues and gains. Thus, all revenues are incomes but all incomes are not revenues. For instance if a restaurant makes GHS20,000 from sale of food and drinks (revenue) for a quarter and earns GHS300 on its 3-month fixed deposit (gain), its total income is GHS20,300.

Types of business expenses

Two types of expenses exist: direct and indirect. Direct expenses are those that can be traced to a particular person, department, activity or item. Those that cannot be linked to a specific particular person, department, activity or item are indirect. As a case in point, expenses incurred to convey medical products (carriage cost) to a store house is direct whereas salary payment for employees is indirect for a pharmaceutical firm.

Important points to note

- The financial performance of every business depends on revenues and expenses. Strive to improve your revenues and reduce your expenses. This should not negatively affect service delivery.

- Monitor your revenues and expenses regularly. Analyze differences with budget and take corrective actions where necessary.

- Arrange for cost-effective ways of incurring expenses where possible

The above are intended to help you appreciate revenues and expenses so as to aid you manage your business better.

expensegainlossesrevenue

Leave a Reply