Why Profitability Is Key to Assessing Your Business Growth

Every emerging organisation be it small, medium or large has certain inherent reasons for its conception. The nature and characteristics can further explain the type of business in question, as to whether or not the business is profit making, nonprofit or a charitable organisation. In this article our focus will be on profit making organisations.

Profit making organisations are those organizations established and operating with the intention of maximizing profit and increasing output of goods or services. But what happens when instead of making profit you’re barely making head way? A common complaint from business owners and entrepreneurs is that they don’t feel like their businesses is making enough money. ‘’They’ve toiled all night but caught no fish’’.

What is the root of this? It could be many different reasons accounting for your business not experiencing growth. Let’s take a look at these three common reasons why your business is not profitable and what could be done to resolve them;

Your business isn’t attracting the right customers/clients

You might be providing the best services or have an excellent product but can’t convert to paid clients. If your business is attracting the wrong kind of customers or isn’t attracting any at all, then it might be time to go back to the drawing board.

Most businesses that are new tend to neglect customer loyalty and focus on generating new business. Tracking your customer’s behavior and activity on your website, social media, and through email marketing is just as important now as it was when they were only a lead. So, ideally, you’d like to see your current customers continue to engage with your content and keep you at top of mind, when its time to make a new purchase or refer a friend. Your customer’s behavior tells you a lot about their satisfaction and whether or not they will remain a customer.

Your ability to maintain your customers helps convert your excellent product or service into paid clients and by so doing realizing profit and expanding your business.

Your pricing strategy is wrong

The question is how did you come up with the prices you charge for your product or the service you provide? Many businesses make the mistake of basing price solely on what their competitors or others are charging or what they feel is fair. If you expect your business to grow as well as be profitable, then my friend, this is a wrong approach.

You have to take into consideration what it takes to make your business profitable. Learning as much as you can about your customers will help you accurately price your products. Are they bargain hunters? Do they value quality over mass consumption?

After analyzing the above, you then have to consider your business expenses, your desired salary, and your tax liabilities. This at the end helps you know your minimum gross revenue.

Important decisions must be made in evaluating your business. Charging abnormal prices on your product or service only turns your customers away instead of bringing them in. As a beginner you don’t need to focus so much on the profit but aim at being unique and standing out among your competitors and your customers will be willing to pay more for your services and thereby increasing your profit margin.

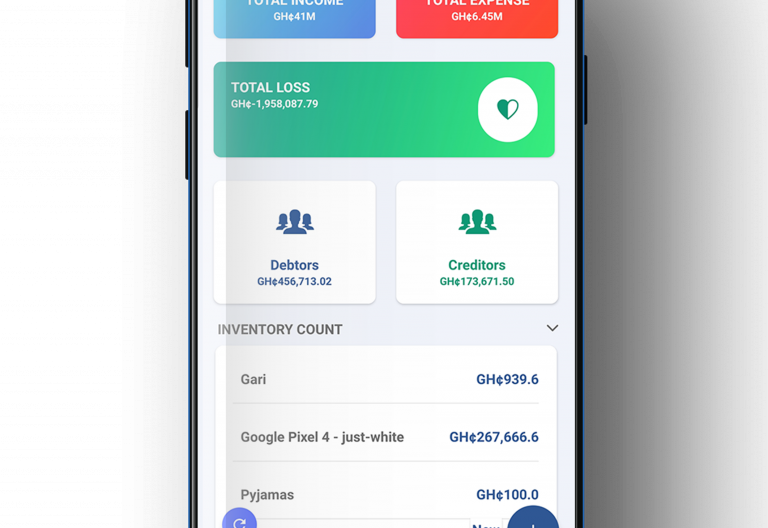

You have no proper bookkeeping

You have no idea how much you’re making because you aren’t recording or tracking your transactions. It is imperative to note that “what gets measured gets managed.’’ If you have no idea what your business cash flow or income is, then you will never have a good grip on your business’s finance.

Your cash book should be a record of transactions that are legitimate business expenses such as materials and supplies. Because they are legitimate business expenses, you will need to transfer the records of these transactions from your cash book to your general ledger in order to claim these expenses as deductions. Allocate these expenses in the appropriate categories. Also record the sums that you withdraw from your bank account to transfer to your petty cash fund by noting them in your banking ledger.

To keep a cash book, write the sum of money you use to start your petty cash fund, and then list and subtract the amount of each purchase that comes out of the fund. When you use up the amount you used to start your petty cash fund, add more money, and note the amount you have added in your petty cash book. Periodically reconcile the account by making sure the amount in the fund matches the balance noted in the book.

In a nutshell, for your business to grow and be profitable, certain methods must be adhered to and these are not exceptions:

Develop excellent customer relation plans; be it face-to-face, social media, or on your website. When your customers feel at home they will be willing to pay more for your product and services.

Reasonably price your product to favor both parties (the producer and the customer) and when the product is affordable to all you will be able to convert your product or service to a paid client.

Keep up to date books of all transactions; by so doing you will know what comes in and what goes out of your business and what you are able to retain at the end of the day.

Worry No More

There is no need to worry if you have no idea how to properly manage your bookkeeping. We understand that when it comes to financial matters, keeping up-to-date books and achieving your business goals can be hectic. Built Accounting gives you exactly what you need with professional guidelines while you focus on your day-to-day activities of your business and keeping cost as moderate as possible. With Built, your satisfaction is our benchmark. Contact Built via email (hello@builtgh,com) or call 030 397 4832 for all your business accounting needs.

financetipsprofit and loss

Leave a Reply