Marketing is an important part of every business. No wonder it is said that, “doing business without advertising is like winking at a girl in the dark. You know what you are doing but nobody else does”. For most businesses, especially those in the early stages of their operations with few data set on their customer acquisition cost and channels, what to allocate for budgeting is a bit of a difficult decision to make.

Marketing is an important part of every business. No wonder it is said that, “doing business without advertising is like winking at a girl in the dark. You know what you are doing but nobody else does”. For most businesses, especially those in the early stages of their operations with few data set on their customer acquisition cost and channels, what to allocate for budgeting is a bit of a difficult decision to make.

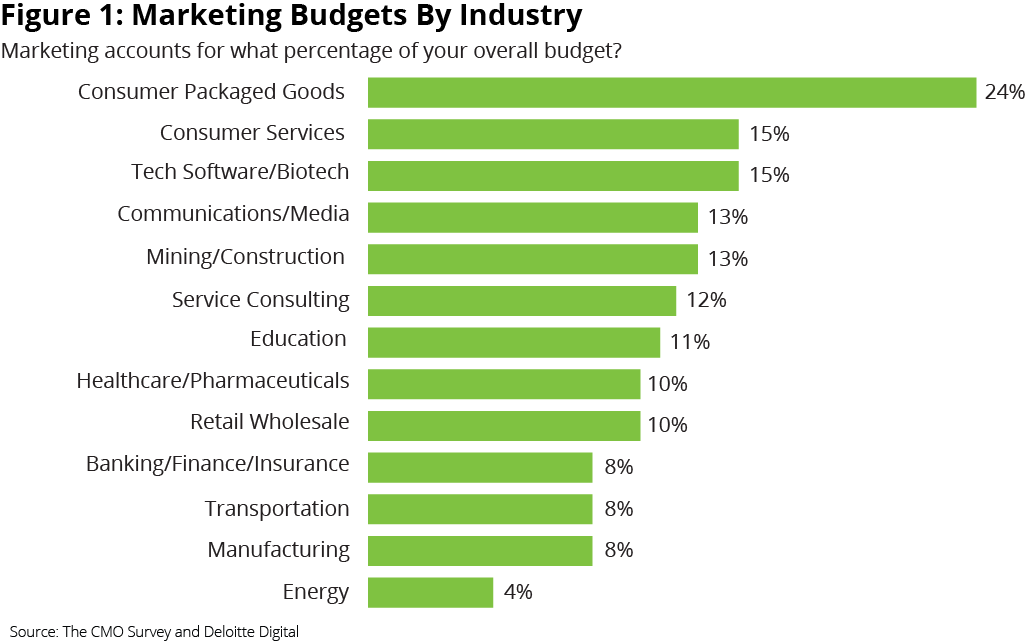

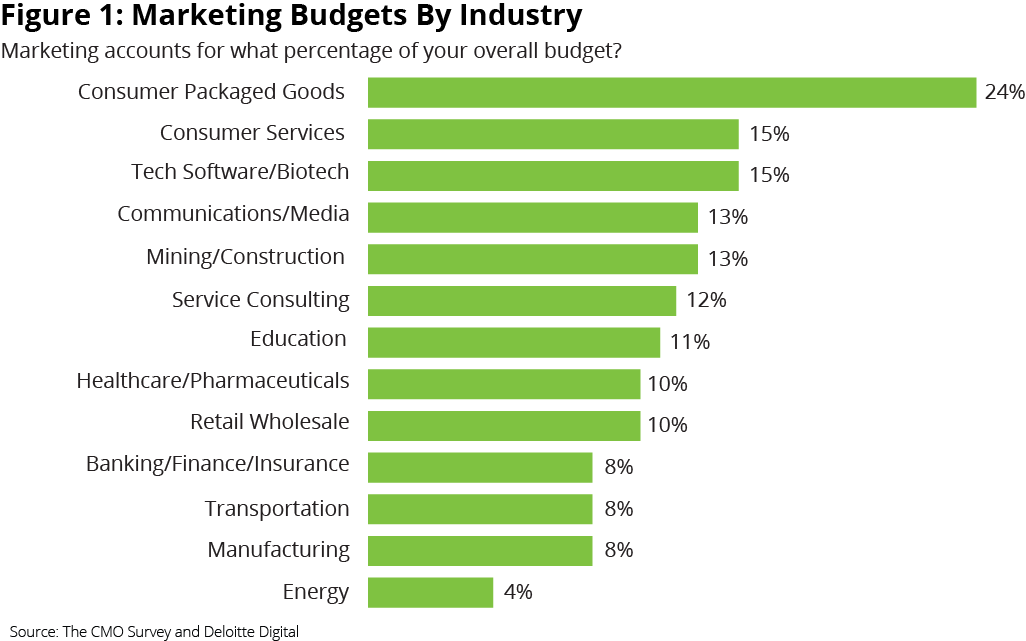

A recent survey has thrown lights on what many companies are spending on their marketing activities. This gives us an idea when planning for marketing in our budgets. The survey goes on to show the percentage spending per industries as well as the marketing expense items typically used by the companies surveyed.

Marketing Budget Based on Industry:

The industry that a company operates in has a huge influence on how much they spend on marketing. For instance, in Consumer Packaged Goods (CPG) industries, especially the internet first, direct to consumer (DTC) companies such as Warby Parker, Harry’s etc, marketing plays a very big role in the customer acquisition processes and that’s why they command a huge marketing budget. From the survey such industries command about 24% of budgeted revenue. However, in industries which are light on marketing and more of referrals and has high switching cost, the marketing budget is found to lesser. For instance, more traditional industries such as Transportation, Manufacturing and Energy have lower marketing budget.

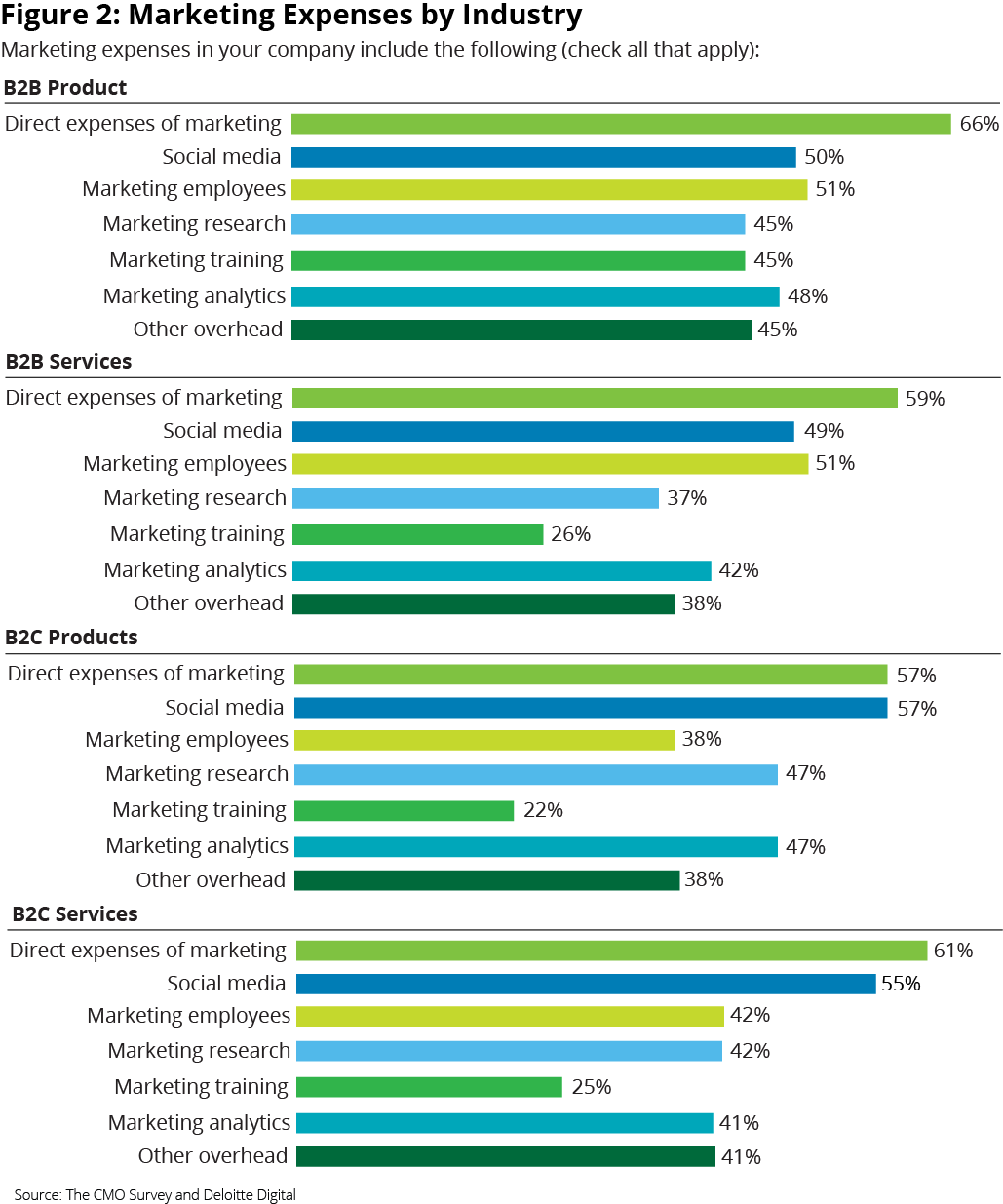

Marketing Line Items by Industry

Also, the industry affects the marketing line item that businesses typically spend on. Contemporary channels such as social media is a major line item in all the industries. However, marketing employee expenses are higher in some industries, even more than social media, due to the huge role marketing staff play in those industries, such as B2B Products.

Leave a Reply